Malta Budget 2017 – General overview

David Farrugia

Array

18 October, 2016

Finance Minister Prof. Edward Scicluna announced various measures in the Budget Speech for 2017. These include fiscal amendments targeted to enhance investment in shares listed in the Malta Stock Exchange (“MSE“), reduction in stamp duty on transfers of businesses from parents to their children, and other incentives aimed to encourage restoration of properties in an Urban Conservation Area (“UCA“). Other social measures include exemptions on pension income.

For further information about the principal measures to be introduced kindly click here.

Looking for a First-Class Business Consultant?

Get in TouchRelated News

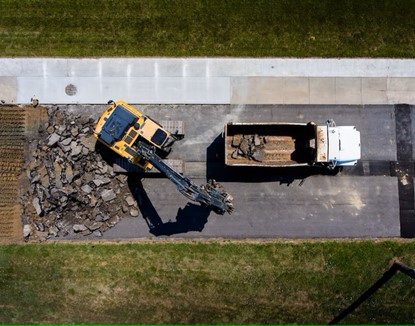

Support for Reducing the Environmental Impact of Construction Activities

8 February, 2023

Array

Equipment and Machinery Grant for SMEs

31 January, 2023

Array

European Funds for Digitalisation Call 4

12 January, 2023

Array

Payroll Adjustments For Year 2023

9 January, 2023

Array

Which companies in Malta are required to prepare audited financial statements?

7 December, 2022

Array

Christmas Shutdown

6 December, 2022

Array

DFK Malta – Budget 2023

25 October, 2022

Array

Support for Initial Investment Projects

7 September, 2022

Array

Update on Legal Notice on Work Life Balance for Parents and Carers

3 August, 2022

Array

Request by the MBR for the provision of an email address for each Company

3 August, 2022

Array

Here are some of our clients