The Investment Aid Tax Credits 2014 – 2020

David Farrugia

Array

26 September, 2014

New guidelines for the Investment Aid Tax Credits were published recently by Malta Enterprise. The guidelines form the basis of the new investment aid scheme which will be in force between 1 July 2014 and 31 December 2020. Qualifying undertakings benefit from tax credits which are quantified as a percentage of qualifying expenditure incurred in terms of the guidelines. Such tax credits are directly offset against the tax charge of the undertaking’s business for the particular year of assessment.

For further details about the Scheme kindly click here.

Looking for a First-Class Business Consultant?

Get in TouchRelated News

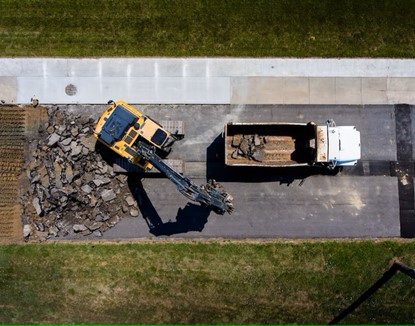

Support for Reducing the Environmental Impact of Construction Activities

8 February, 2023

Array

Equipment and Machinery Grant for SMEs

31 January, 2023

Array

European Funds for Digitalisation Call 4

12 January, 2023

Array

Payroll Adjustments For Year 2023

9 January, 2023

Array

Which companies in Malta are required to prepare audited financial statements?

7 December, 2022

Array

Christmas Shutdown

6 December, 2022

Array

DFK Malta – Budget 2023

25 October, 2022

Array

Support for Initial Investment Projects

7 September, 2022

Array

Update on Legal Notice on Work Life Balance for Parents and Carers

3 August, 2022

Array

Request by the MBR for the provision of an email address for each Company

3 August, 2022

Array

Here are some of our clients